When I am interacting with Client regarding Mutual Funds or when I share some Mutual Funds educational Video, slides usually I get This Question. We understood whatever you are telling us, we also understood the benefits of Mutual funds but what about the disclaimer.

“Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing”

After reading this we go back to our traditional way of investing. My Answer is YES Mutual Funds are subject to Market Risk, but YES there is a way out to manage the risk

In simple terms, risk is an unexpected outcome. For example, you invest in shares, gold, or real estate with the expectation of prices going up after you buy so that you can earn a profit whenever you sell it. But, what if the price falls after you buy? After you purchase, the share, gold, or real estate price moving in the opposite direction (down) "than expected (up) is known as risk.

In Daily Life, we come across many Risks while crossing roads, while driving a car/ bike, while travelling in trains/ planes etc, but with due precaution, we manage these risks.

Mutual fund schemes invest in securities that are market-linked, for example, stocks in the case of equity schemes. All mutual fund schemes are valued every day, and the NAV fluctuates with the respective changes in the market. Thus, making schemes prone to market risks. Now, a scheme related document provides you with all the relevant information about the scheme, the investment strategy, which sectors is it invested in, etc. This document can give you an estimate about the amount of risk, your investment is prone to and thus, for you to know that the NAVs and returns shall keep changing depending on market behaviour and that volatility is inseparable from mutual fund investments.

As a first step, discussion with Advisor is a must where we understand the Investment objectives, Goals, Cashflow etc and based on this Mutual Funds schemes/ portfolio will be selected.

While investing we suggest Client to go as per Goal-Based Investments methodology. Based on the discussion we identify the Number of Years the Investment should be to achieve Goals.

For example, if a kid’s current age is 3 Years then for Graduation expenses Goal, we have 15 Years for investment to achieve it.

With this data, we select the type of Mutual Funds. In between if the market moves down we don’t have to worry since our Goal is after 15 Years.

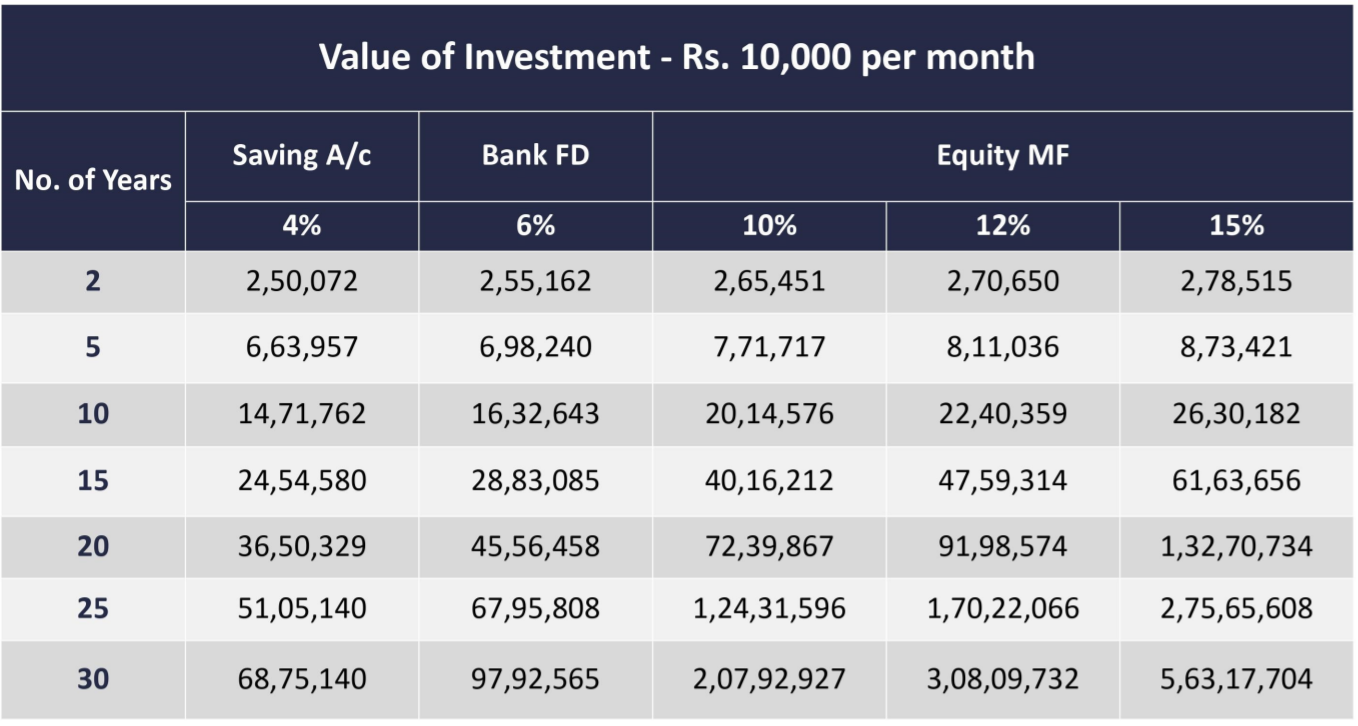

In this way, the Risk associated with Mutual Funds Investments is managed. It is necessary to have an adviser to guide better regarding the risk and its management. The below table will demonstrate a comparison between FD Investments (Less Risky) Vs Mutual Funds Investments

Hence not investing in mutual funds is the biggest risk of all. Even if mutual funds are subject to market risks, you can address these risks with appropriate asset allocation, proper diversification, and regular disciplined long-term investments.

We help you choose handpicked and lucrative funds recommended by experts. Go for our 100% paperless investment that saves on cost, time, and effort.

Your investment proof will be sent to your email instantly.

Invest Now!!